Insurance Capital Adequacy Ratio abbreviated as CAR is widely used to determine the health as well as financial stability of the insurance companies. In this context CAR is more or less simply the result of the provision of available capital as a fraction of the minimum required capital. Earnings per share by the total number of shares gives this ratio importance since it enables an insurer to know how it would perform when faced with scenarios like adverse economic conditions, which necessitate the payment of claims. Findings have shown that higher capital adequacy ratio is a strong signal of financial strength and credibility to ensure that its obligations are met as per regulatory requirements, policyholder and investor expectations. In this article, the reader will be offered some essential information regarding the idea of the decryption of the term, its importance, the legislation related to this problem, and the general influence on the sphere of insurance.

What does the CaR stands for in Insurance?

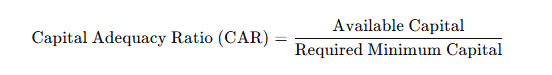

In the insurance sector CAR represents the amount of capital that an insurer has over the minimum amount of capital required. It shows the level of preparedness of an insurer to face some unforeseen losses or other risks common with an insurance company. The formula generally used to calculate CAR in insurance is:

This ratio is shown as an amount per $100, otherwise referred is a percentage, where higher figures are preferable.

Why CAR is important in insurance

- This area of capital is critically essential for the insurance industry, as the insurance business exists in the realm of providing cover for risks and exposures for an uncertain period. The following points explain the importance of maintaining an appropriate CAR for insurers:

- Policyholder Protection: The higher the CAR ratio, the capability of an insurer to meet its policyholder’s claims. This means that the higher the CAR the more the insurer has adequate capital to meet the policy holder’s claims hence policy holder security.

- Financial Stability: The higher the CAR of an insurer the more likely they are financially stable, a fact that goes a long way in winning the approval of rating agencies. Availability of a good rating enhances the credibility of customers too as well as the market reputation.

- Regulatory Compliance: CAR is requirements expected in regulatory bodies that insurers need to meet before operating. If the company does not do so, penalties follow or the worse scenario the operating license is withdrawn.

- These risks are in some extent managed in such a manner that the access to CAR makes it easier for insurers to conduct their businesses.Accompanied with a high CAR, a company will always have adequate capital to cater for these losses, this comes in handy especially during volatile economic conditions.

- Competitive Edge: Insurers with better CAR can make happen more business and policyholders because they are considered superior in financial base to competitors with inferior CAR.

The present study focuses on the establishment of the regulatory framework and the determination of some CAR requirements.

Different bodies across the globe have set several CAR, which the insurance companies must meet. Some prominent regulatory frameworks include:

Solvency II (Europe): Hedging is a global framework that is used where an insurance company is situated in the European Union. It is based on three pillars:

The requirements that are provided by Pillar 1 consist of quantitative elements, for example minimum capital.

In the strategic plan Pillar 2 relates to governance and risk management.

The third Element revolves around the area of reporting and disclosure.

Risk-Based Capital (RBC) (USA): In the USA insurance regulation at the state level is performed by National Association of Insurance Commissioners, under which the mentioned RBC model was adopted, in particular the RBC system.The RBC requirements provided a minimum level of capital base for credit institutions in relation to the relative level of risk.

International Association of Insurance Supervisors (IAIS): IASIS, in cooperation with the Insurance Capital Standard (ICS), stimulates the adoption of international practices regarding the minimum level of insurers’ capitalization. Yet again, as an organisation in its developmental stage, ICS seeks to ensure that the competitive environment is achieved around the world for insurers.

These frameworks and regulatory guidelines play a crucial role of making sure that insurance companies have adequate capital in order to accommodate their risks and meet their policy holders needs.

Factors influencing Capital Adequacy Ratio

- The capital adequacy ratio is influenced by various factors, including:

- Risk Profile of Insurers: The CAR may be relatively high for companies in the high-risk industries (for instance those in property or health insurance).

- Market Conditions: Volatility in the position of the markets affects the stock of insurers to varying degrees, and therefore threatens the more limited available funds.

- Reserves and Liabilities: Insurers need to allocate sufficient amount to be put aside to meet the expected claims. This means that if a bank has not reserved adequately it will post a lower CAR.

- Investment Portfolio: In general, insurance companies use the collected premiums to make money or get some kind of profit. Nonetheless, investment returns have an eight-step influence on CAR where poor investment performance leads to erosion of capital.

- Operational Costs and Expenses: This passes on operational costs which deny the organization capital thus lowering the CAR.

Interventions to Strengthen CAR:

- Given the importance of maintaining a robust CAR, insurers often adopt various strategies to improve or sustain their capital adequacy ratio:

- Effective Risk Management: Insurance companies use tools such as reinsurance which is the process of insurers transferring their risks to other insurers in order to mitigate on their exposure.

- Capital Injection: In case of negative CAR, an insurer may seek permission to knock down its capital through equity or debt offers.

- Cost Efficiency: Efficiently managing operations set expenses and expenses in general that prevent insurers from spending much of their capital; all of these have a direct impact on the CAR.

- Diversifying Investments: A low exposure to the major volatile financial markets ensures that the insurers keep off maintaining the CAR capital levels.

- Enhanced Underwriting Practices: Row specifies that rigorous underwriting criteria enable insurers to identify and price the risks well, thus enhancing the quality of their contracts while controlling adverse losses.

CAR and Economic Operations on the Insurance Industry

- Capital adequacy impacts the broader insurance market and the economy in multiple ways:

- Stability of the Financial System: Insurance business occupies a substantial place in the financial system and having huge stakes in many forms of investment. CAR at the sector level is therefore the measure that is used to guarantee that insurers remain strong and thus boosts financial stability.

- Investor Confidence: High CAR is usually preferred by the investors, because it signifies good health of the insurer and its ability to manage risks proficiently. Insurance investiture capital residency allows for expansion and product development of the insurer.

- Reduced Systemic Risk: This means that insures are in a better position to be able to deal with other economic shocks hence the problem of insurer insolvency is mitigated by capital adequacy. The enhanced insurance financial stability has positive externalities on other financial securities.

- 7. Questions in Sustaining a High Current Asset Ratio

- While a high CAR is desirable, insurers often face challenges in maintaining it:

- High Cost of Capital: If the requirement is to raise additional capital through equities or through debt, then it is going to be expensive. This can be especially difficult for smaller insurers operating in a fast consolidating industry while at the same time, it is a good opportunity for the incumbents to expand their already large scale economies.

- Market Volatility: Strategists also face some pulls and bears that diminish capital and challenge the capacity to maintain high CARs, such as: Economic depressions, Interest rate fluctuations, or Market fluctuations.

- Increased Regulatory Compliance Costs: CAR is regulated by the rules that may take many resources, persons and tools, such as a compliance department and reporting tools which costs money.

- Pressure to Invest: Insurance focuses on earning returns on invested capital, therefore capital intensity and the insurance business’s risk tolerance impact CAR where insurance organizations make excessive capital investments in pursuit of higher returns.

In conclusion, the CAR initiates the insurance regulators as the minimum measure of capital that an insurer should hold to meet policyholder obligations and any potential adverse conditions. Consequently, CAR is a significant component of architectures, ensuring policyholder confidence, industry stability, and competitive advantage for strong insurers. Headwinds however remain apparent, ranging from cost of capital to market conditions but with good risk management, optimal investment and operating leverage, insurers can either maintain or indeed enhance their CAR.

From the perspective of policyholders, investors and regulators also, a sound CAR position has clamour for the insurers’ financial stability and believably putting emphasis of capital adequacy as a key component of insurance market sustainability.